Top 10 Fintech Mobile App Development Providers 2026

With countless fintech providers leading the industry, India is recognized as one of the biggest fintech powerhouses across the globe. Also, with technology upgrading itself every day, fintech institutions are considering it mandatory to include the upgrades and developments in the services that they provide. This requires the guidance of a fintech app development company to both the customers and the fintech employees.

The reason for this gradual transformation and easy adaptation is that the need is being evidently felt. Also, the number of customers adhering to the mobile app fintech services over the past decade has been growing. This blog analyses and helps you choose the top fintech mobile development providers for 2026 and provides expert tips to choose the best ones.

Overview of the Fintech Market and Its Growth

The global fintech market has been growing and expanding over the past few years, helping customers meet their needs fast and assisting the fintech employees in accomplishing their tasks even faster. One of the main reasons for this successful growth is the adherence to the latest mobile technologies that enhance operational efficiency and have begun to be considered as the norm. Another reason for this consistent growth is that customers have switched from manual functioning to digital technology usage, to switch to the mobile-first fintech approach.

This expansion of the fintech market has enabled organizations to meet evolving customer requirements instantly and in parallel at significantly lower costs. As a result, the industry is rapidly developing advanced web and mobile platforms that enhance and streamline financial operations. Most importantly, the sector continues to focus on identifying, evaluating, and mitigating potential risks using the most effective, cutting-edge technologies that are expected to become standard across industries within the next five years or less. Today, fintech innovation is powered by futuristic solutions such as artificial intelligence, blockchain, Internet of Things (IoT), Super Apps, Neobanking and open banking APIs, each playing a crucial role in transforming financial services and keeping pace with growing customer demand.

Years apart, the fintech market is expected to grow even bigger with automated asset management, AI management of digital assets, and hyper-personalization in financial services. While there are plenty of updates expected, the industry holds plenty of employment opportunities for job seekers, too.

Leading Fintech Mobile App Development Agencies 2026

Here’s a comprehensive list of the top fintech mobile app providers 2026 who’ve been recognized for their services and the benefits they offer to their customers:

AppInventiv

One of the top-recognized providers for financial software development, AppInventiv, is known for its user-friendly and simple apps they deliver. Firms are looking for a mobile-first user experience. The company not only provides its services in India, but also serves customers across the entire globe. A unique aspect of this company’s app services is that it guarantees users the most unparalleled user experience. Lately, AppInventiv is also into providing blockchain and AI-integrated tools and assistance, scalability, and security. A major reason why they lead the fintech mobile app field is that they focus on providing brand-oriented financial solutions and services that generate more leads and drive high brand engagement.

DigiPay Guru

DigiPay Guru is another one of those well-recognized providers of secure and compliant fintech apps

that has been leading the competitive race for many years. An exclusive feature of their app is that they deliver apps with a balance of both innovation and usability. Secondly, it is a white-label platform that comes with a customizable digital wallet app development feature and remittance suite, which allows new users to sign up with fewer steps. Also, people choose DigiPay Guru for being available in its web and mobile versions, avoiding frequent logins. Being integrated with AI and ML algorithms, it helps users make real-time analytics and plan their investments accordingly.

VivaSoft

Custom banking services are a feature that something that excites every user, as these apps provide banking services based on the user's banking nature and requirements. VivaSoft is a good example of VivaSoft as it provides banking services aptly based on the user's needs. Apart from the usual banking services, this company also assists customers in providing borrowing and lending services. Also, every app developed by Vivasoft comes with predictive insights and regulatory compliance to safeguard the personal information of users and make sure that they’ve got only authenticated access.

NetGuru

Aimed in simplifying the entire concept of mobile banking, NetGuru helps develop mobile apps for investment, banking, and Fintech solutions. This company is a popular choice for cross-platform fintech app development services, especially for its advanced security feature integration for the documents included in the app. Their apps are also bound by AI and ML operation features that suggest tips and information to make their financial decisions efficient. Depending on the increase in users, the company extends is usability to more users with a great backend support.

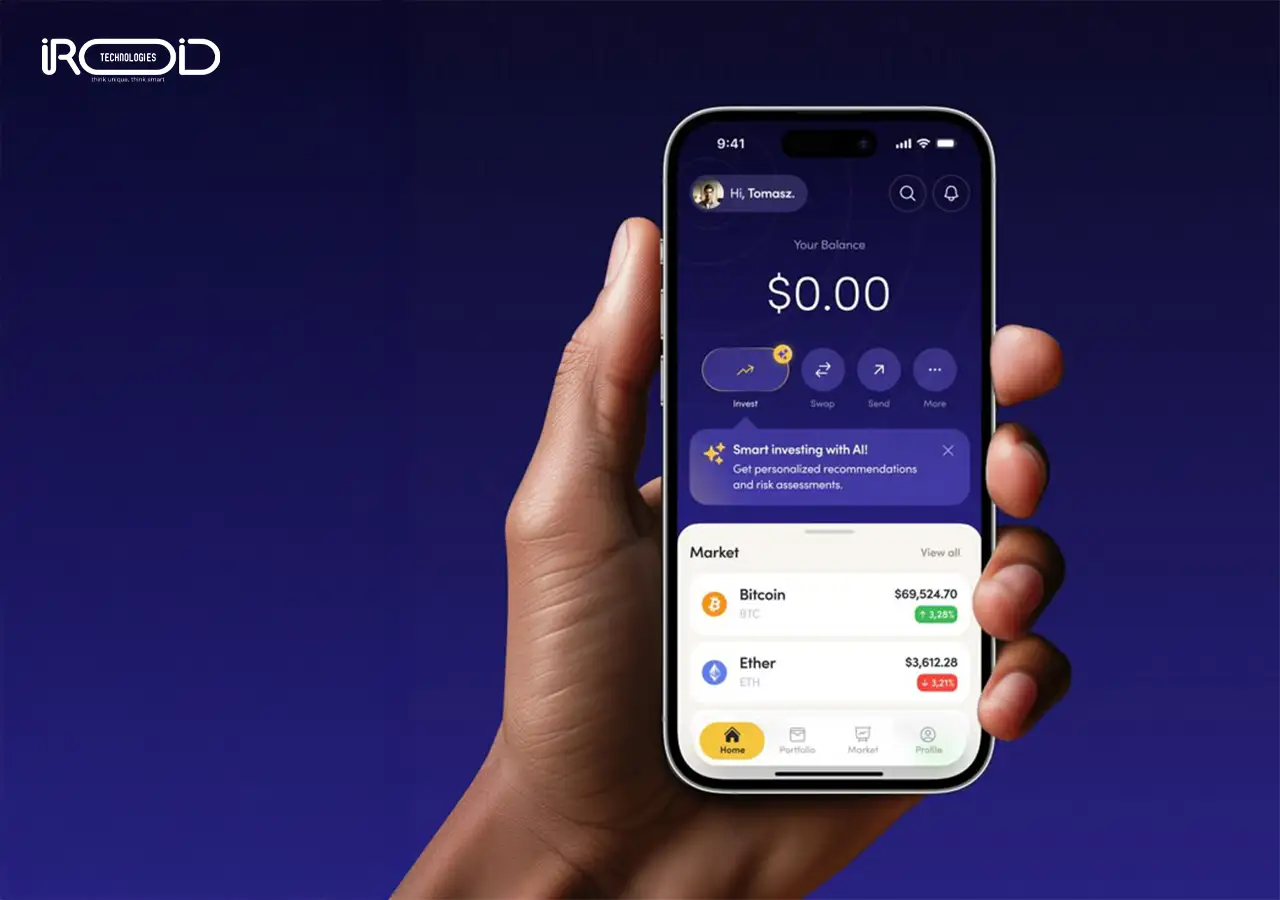

iROID Technologies

Iroid Technologies has been noticed for its fintech mobile app development services across both web and mobile platforms. Every app that they deliver is of high performance and acts as a scalable solution for several industries. There is also a guarantee that the app offers high security and protection, especially to sensitive and personal information. Also, their app stands on par with the others for using the latest, innovative, and cutting-edge technologies such as IoT, cloud computing, and advanced data analytics. Most importantly, their services are wrapped with after-sales services, timely deployment, and maintenance support.

RipenApp Technologies

If you’ve been accurately in search of an impactful, deliverable app solution for your business, then RippenApp Technologies can make it happen for you. They deliver fintech mobile apps that simplify lending needs, banking, investments, and provide the best digital wallet app development services altogether. Also, they adhere to and refer to the latest laws and regulations in relation to the financial app development and make sure that the developers follow them as and when required. The company is known for developing banking solutions, lending, and investment platforms to reduce the time taken and enhance the mobile banking process to make it technology-driven.

Fingent

Two decades into fintech mobile app development, fintech mobile apps developed by Fingent are well-recognized and stand out for their services. Some of the domains where they provide app assistance are in fintech app development, blockchain app development, robo-assistance, and AI assistance, whereby the users get efficient guidance before making financial decisions. The company ensures that the app it delivers comes with robotic assistance, which automates regular tasks such as monitoring shares, buying, and selling them. This is the reason why Fingent’s FinTech mobile solutions are in demand all over the world.

Mambu

Mambu has been leading the forefront of FinTech solutions by working in accordance with the modern banking infrastructure. However, the company focuses on developing solutions without overwriting the existing mobile banking infrastructure. Therefore, it is a known choice amongst banks, digital banks, and neobanks for enhancing and establishing their digital banking services or extending the same across a new location. This company excels in renewing and upgrading its laws according to the new ones being introduced by the firms.

F22 Labs

F22 Labs has been a constant presence in the fintech mobile app development over the past decade. One of their unique mode of working is their constant research and usage of inputs for the development of rare, beneficial, and successful apps. They are also demanded for the SaaS, MVP, and product-related apps, all of which are simple and user-friendly in nature. One of the reasons that they’re frequently chosen is for their deadline adherence, which is always accurate, and also their after-sales service, that are affordable and fully budget-friendly.

Mobifin

Mobifin is one of those transformative mobile banking app development firms that imbibe and uses both the traditional and modern app development technologies. They specialize in apps that assist with digital banking, microfinancing, and as a method of easing microfinance services. Something that makes Mobifin impressive as a choice for app development is that they research and deliver apps that follow both the traditional and modern approaches. Another exciting feature that Mobifin’s apps provide is the offline availability of the features in an uninterrupted, easy-to-use manner.

How to Choose the Right FinTech Mobile App Development Company

Having a successful fintech mobile app depends largely on selecting the right mobile app development company after a thorough analysis of the requirements. Here are the steps that can help you make a wise choice:

Step 1: Understand the requirements and vision

Just as the requirement for a fintech mobile app pops up from a client, invest time to accurately understand the need for the app. Before you go for an app, the first step is to analyze the benefits, the unique features, and the problems that the app would solve. Selecting the right niche and planning for the future of the app is what makes it successful in the outlook. The revenue models for each niche are different. Spending time reading and understanding them helps in making effective decisions about the app’s vision and future.

Step 2: Make the regulatory compliances

Developing an app within the fintech sector means understanding the legal and regulatory compliance and adhering to it from the beginning. Compliance is not just a mandate, but is meant to safeguard the privacy and security of the users. Some such compulsory compliances are Know Your Customer (KYC) and Anti Money Laundering (AML), which help users verify unauthorized transactions and access and block them the very moment of being noticed. Creating and maintaining regulatory compliance is something that takes a lot of time for a fintech mobile app to do.

Step 3: Plan the necessary features

A major factor for users choosing a specific app for digital payments and transactions is the features it comes with. Two such inevitable features are security and user experience, which is to be consistently maintained throughout the app till its existence. One such security feature is the 2FA (two-factor authentication) that protects data and prevents unauthorized access. The second feature is the user-friendly interface where there are minimum features but brings maximum security and user engagement.

Step 4: Choose the right tech stack

The tech stack is what determines the operational efficiency of the fintech mobile application. The app’s backends can probably be worked with Node.js or Ruby on Rails, or even Python, as they offer flexibility and ease of use. Front-end can use React Native and Flutter. However, both these technologies together can also be used if you are aiming for cross-platform development. To top it up, cloud integration is provided to keep the data safe and secure. This ensures data security and accuracy.

Step 5: Double-check the security features

Let’s just say, check the security features at every phase and make sure that they work perfectly. Making the app encrypted from end-to-end, adding SSL certificates, and AES-256 certificates also adds up as an additional security layer. At the same time, make sure that there is threat detection and security assistance, and test it well before proceeding with the other app development steps.

Step 6: Financial API Integration

Financial API integration ensures that all app features are consistently accessible to every user. For example, authentication in certain banking apps can sometimes take longer to load, but with proper API integration, this time is significantly minimized. This capability is essential for modern mobile banking apps, UPI apps, digital investment platforms, and payment gateways, where speed and reliability directly impact user experience. In short, financial APIs enable multiple bank accounts and financial services to operate seamlessly on a single platform without conflicts.

Step 7: Test the App

The app requires thorough testing and issue detection before being used for actual financial requirements. This means that the app is to be tested at every phase through real-life instances and measured for its impact. For the best results, it is suggested that you use a high-quality mobile app testing platform to detect and resolve issues before the reviews go against the app.

Step 8: Launch the App

Now, the app is all set to be launched for the company and its potential customers. This is a combined effort of the digital marketing team, the mobile app development team, and the research team as a whole. Hence, it is up to you to decide the platform of launch- PlayStore or AppStore, wherever you think the app could do the best for its users. But, do not forget to keep an eye on the feedback, reviews, and suggestions that add to its improvement.

Step 9: Work on maintenance and updates

Now you may do the brush-ups of the app wherever you feel is much needed. The app performance can be easily measured and monitored on platforms like MixUp or Google Analytics, where you get a downloadable report that can further be used for improvement. As the app gets more use, you may work on fixing the bugs, issues, and other anomalies.

Conclusion

Fintech apps are increasingly in demand, and the development companies are on a race against each other to become the best. However, becoming the best requires a good knowledge base, a professionally strong team, and staying updated with the latest trends and happenings. Though each company’s offerings may differ, it is ideal to compare them, analyze the needs, negotiate, and go for the best provider. Remember, the aim isn’t to develop a unique fintech app, but to keep it the best no matter what and how many years pass.